Gamestop, Reddit & Robinhood Walk Into a Bar

The goal is simple: screw the short-sellers. The future of Fintech is weird.

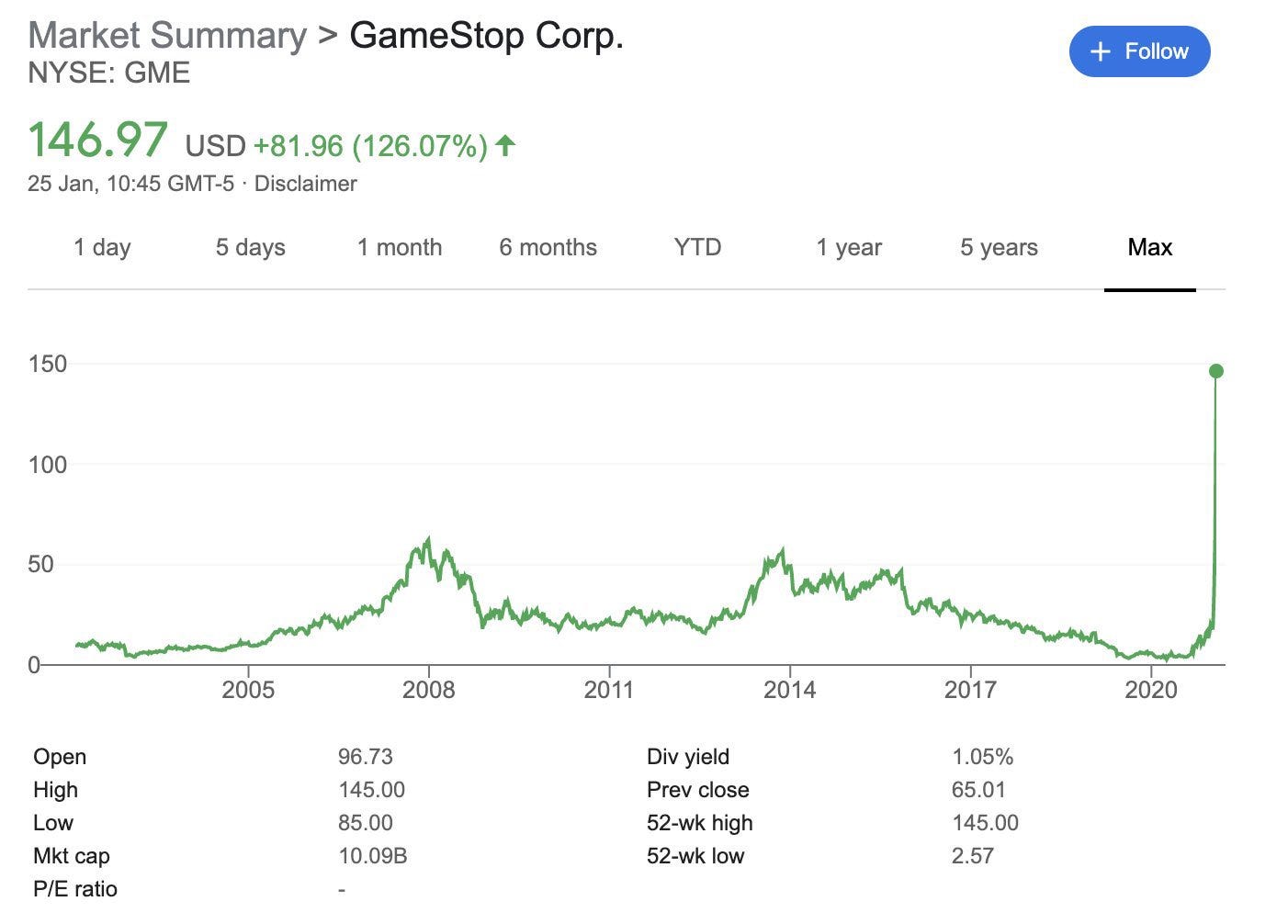

As you can tell from the graph above, Gamestop, stock symbol $GME, is having a wild couple days. By the looks of it, it looks like Gamestop just figured out a way to distribute the Covid-19 vaccine through a Call of Duty software update. But in fact, Gamestop has done nothing to “deserve” this dramatic stock price increase.

It has everything to do with, you guessed it, the internet.

If the internet can pump up a digital currency to crazy numbers, you better believe it can do it with any stock it wants. It just needs a little coordination and an easy way to do it.

Long story short, Reddit users from subreddit Wallstreetbets all coordinated when they were going to buy $GME to bring the stock price up so the short-sellers wouldn’t hit their target price. That forced the short-sellers to then purchase more stock to cover their losses that drove the price up even more.

And do you know of any apps that make ridiculously easy for a bunch of internet users to buy stock? Robinhood does.

One of the biggest hitting hedge funds around, Melvin Capital Management has lost 30% in 2021 due to a series of short bets gone awry, Gamestop being one of them. Citadel LLC and Point 72 Asset Management are investing $2.75 billion to cover these losses.

Fintech is bringing power to the people, and remember the golden rule: The internet always wins.

As always, here’s what you need to know about what’s happening in Fintech.

Plaid and Visa’s deal is cut short by the DOJ

The last quarter of 2020 had many of us expecting there were going to be some huge deals finalizing early 2021. Surprisingly, Plaid and Visa will not be one of them. After announcing in January 2020 that they would be merging with Plaid, It has recently been announced that Visa’s deal has been scrapped due to the Department of Justice’s concerns that the merger would unfairly limit the competition in the payment industry. I wouldn’t be surprised if this wasn’t the only highly anticipated deal that is abandoned this year as well.

Digital Banks customer base has increased thanks to stimulus checks

Citizens aren’t the only ones who are receiving help through the stimulus checks. Neobanks like Chime, Current, and Varo have gained a lot of customers by helping people process their stimulus checks. In fact some digital banks let their customers withdraw the money early and even processed the checks quicker than traditional banks. Neobanks’ ability to get people quick money and perform well under pressure has more people looking toward their services than ever before. Traditional banks still hold a vast majority of U.S deposits but it seems the digital bank trend is growing at an rapid rate.

Walmart to create fintech start-up with the investment firm behind Robinhood

In a move that’s surprising to no one, Walmart is creating their own fintech start-up in the hopes of reaching their millions of customers who don’t currently have a relationship with a bank or financial advisor. The world’s largest company by revenue is partnering with Ribbit Capital, who has invested in other fintech companies like Robinhood and Credit Karma. Their massive consumer base will undoubtedly give them an advantage in reaching previously unreachable markets.

Fintech startups begin year with blistering fundraising pace

While many of us (myself included) are just trying to stick to our new years’ resolutions of eating healthy and going to the gym, fintech startups have been busy fundraising during these first 3 weeks of 2021. Investors are currently paying years ahead for what they believe these fintechs can become. Will these mega-rounds of investments be able to scale and thrive, or will they fizzle out like my Planet Fitness membership in a few months?

What Mastercard’s Fintech Deals Say About Payments

Asia has always been a force when it comes to tech, especially in 2020. Recently, Mastercard has announced a batch of Asian fintech companies in its accelerator and partnership programs. These partnerships are a leg up for Mastercard, as they help extend their capabilities to promote electronic payments acceptances among merchants and facilitate credit to people via new models.